About Top-rated Bankruptcy Attorney Tulsa Ok

About Top-rated Bankruptcy Attorney Tulsa Ok

Blog Article

Some Known Questions About Chapter 7 Vs Chapter 13 Bankruptcy.

Table of ContentsThe Definitive Guide to Best Bankruptcy Attorney TulsaThe Ultimate Guide To Tulsa Debt Relief AttorneyChapter 7 Bankruptcy Attorney Tulsa Fundamentals Explained6 Easy Facts About Tulsa Ok Bankruptcy Specialist DescribedThe 8-Minute Rule for Tulsa Bankruptcy Attorney

The stats for the various other main kind, Chapter 13, are even worse for pro se filers. Suffice it to state, talk with a lawyer or 2 near you who's experienced with bankruptcy law.Lots of attorneys likewise provide totally free appointments or email Q&A s. Take advantage of that. Ask them if insolvency is certainly the right choice for your scenario and whether they think you'll qualify.

Ad Currently that you have actually decided insolvency is without a doubt the ideal training course of action and you ideally cleared it with a lawyer you'll require to get started on the paperwork. Before you dive into all the main bankruptcy forms, you must obtain your very own files in order.

Some Known Incorrect Statements About Tulsa Bankruptcy Legal Services

Later on down the line, you'll really need to show that by revealing all types of details regarding your monetary affairs. Here's a fundamental checklist of what you'll need when traveling in advance: Recognizing documents like your vehicle copyright and Social Safety and security card Income tax return (as much as the past 4 years) Evidence of revenue (pay stubs, W-2s, independent profits, income from properties as well as any type of earnings from federal government advantages) Bank declarations and/or retired life account statements Proof of value of your assets, such as lorry and genuine estate appraisal.

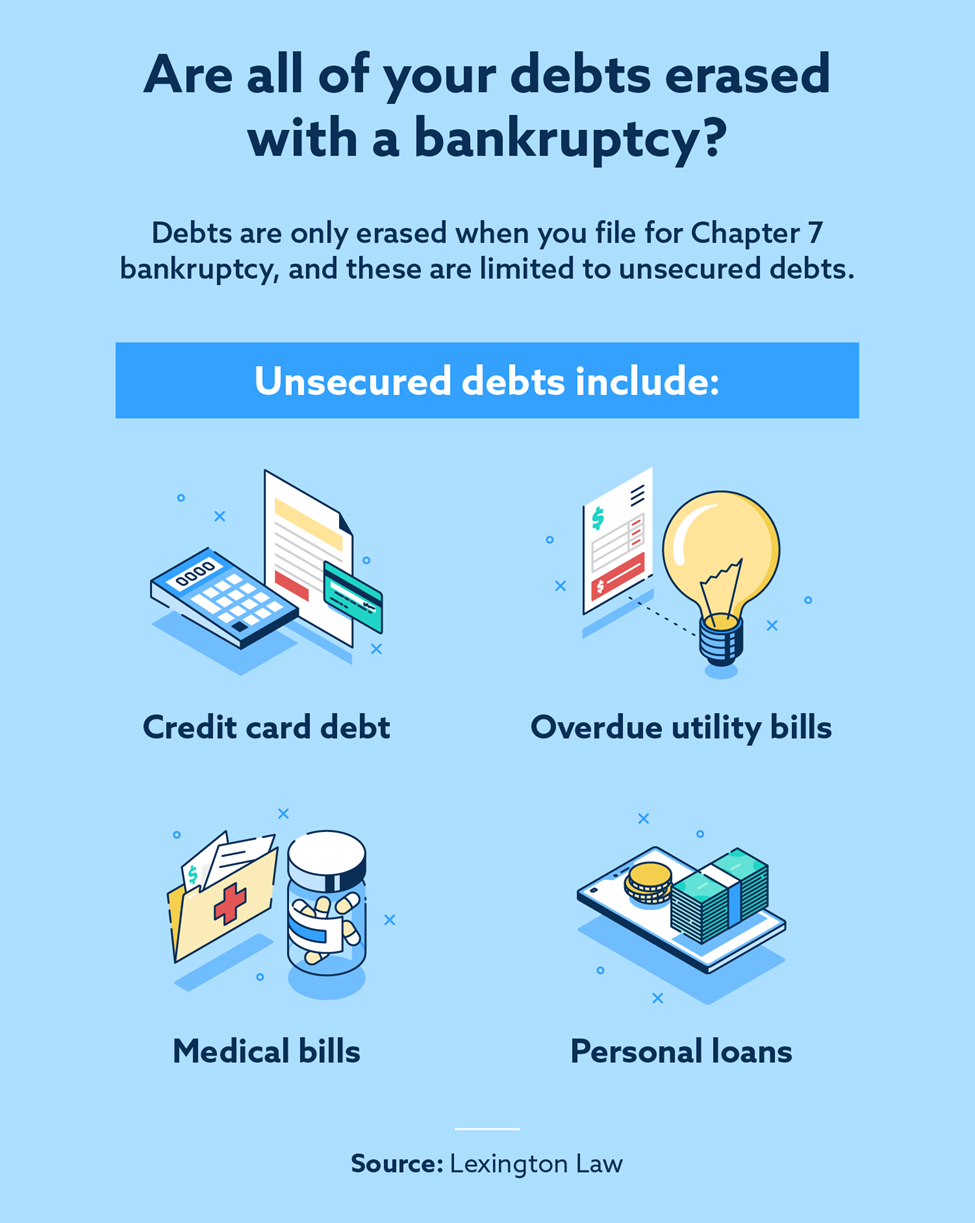

You'll want to recognize what type of debt you're trying to deal with.

You'll want to recognize what type of debt you're trying to deal with.If your revenue is expensive, you have one more alternative: Phase 13. This alternative takes longer to solve your debts since it requires a long-lasting repayment strategy typically 3 to five years before a few of your remaining financial obligations are wiped away. The declaring procedure is also a lot extra complex than Chapter 7.

9 Simple Techniques For Experienced Bankruptcy Lawyer Tulsa

A Chapter 7 personal bankruptcy remains on your credit scores report for one decade, whereas a Chapter 13 insolvency drops off after seven. Both have lasting effect on your credit report, and any kind of brand-new debt you get will likely come with greater rates of interest. Prior to you send your insolvency forms, you should first complete an obligatory course from a credit rating counseling firm that has been accepted by the Division of Justice (with the noteworthy exception of filers in Alabama or North Carolina).

The training course can be completed online, in person or over the phone. You have to finish the program within 180 days of filing for insolvency.

Some Known Questions About Top Tulsa Bankruptcy Lawyers.

A lawyer will normally handle this for you. If you're filing on your own, recognize that there have to do with 90 various insolvency districts. Examine that you're filing with the right one based upon where you live. If your permanent home has actually moved within 180 days of filling, you should submit in the district where you lived the greater part of that 180-day period.

Usually, your insolvency attorney will certainly collaborate with the trustee, however you may require to send the individual documents such as pay stubs, income tax return, and financial institution account and charge card statements straight. The trustee that was just appointed to your case will soon establish up a mandatory conference with you, known as the "341 meeting" due to the fact that it's a demand of Area 341 of the U.S

You will need to provide a timely checklist of what certifies as an exemption. Exceptions may relate to non-luxury, key vehicles; needed home items; and home equity (though these exceptions guidelines can differ widely by state). Tulsa bankruptcy attorney Any building outside the checklist of exemptions is considered nonexempt, and if you don't provide any type of listing, then all your property is thought about nonexempt, i.e.

You will need to provide a timely checklist of what certifies as an exemption. Exceptions may relate to non-luxury, key vehicles; needed home items; and home equity (though these exceptions guidelines can differ widely by state). Tulsa bankruptcy attorney Any building outside the checklist of exemptions is considered nonexempt, and if you don't provide any type of listing, then all your property is thought about nonexempt, i.e.The trustee would not offer your sports vehicle to immediately settle the lender. Rather, you would pay your financial institutions that quantity throughout your layaway plan. A typical misunderstanding with bankruptcy is that once you file, you can quit paying your financial debts. While insolvency can aid you eliminate several of your unprotected debts, such as past due medical costs or personal fundings, you'll want to keep paying your regular monthly settlements for guaranteed debts if important source you intend to keep the residential property.

The Facts About Tulsa Bankruptcy Consultation Uncovered

If you go to danger of foreclosure and have tired all other financial-relief options, then submitting for Chapter 13 may delay the repossession and aid save your home. Eventually, you will still require the revenue to continue making future home mortgage settlements, as well as paying back any late settlements throughout your payment plan.

The audit could postpone any type of debt alleviation by a number of weeks. That you made it this much in the process is a good sign at the very least some of your financial obligations are eligible for discharge.

Report this page